Top 5 Alternatives to Rocket Money for 2025

Table of Contents

Rocket Money has become a go-to for millions seeking to manage their finances and cut down on subscriptions. Its automated features and bill negotiation services are powerful, but what if it's not the right fit for you? Maybe you find the interface cluttered, the premium price too steep, or you simply want a tool with a different focus.

You're in luck. The financial tech space is filled with excellent applications ready to help. In this post, we'll explore the top 5 alternatives to Rocket Money, helping you find the perfect tool to manage your subscriptions and achieve financial clarity.

1. Monarch Money

Monarch Money is frequently hailed as a top-tier alternative, especially for those who want a complete, holistic view of their financial world. It excels at bringing all your accounts—from checking and savings to loans and investments—into one sophisticated dashboard.

Key Features: Powerful investment tracking, collaborative tools for couples or families, and highly customizable budgeting and categorization.

Why Choose It Over Rocket Money? If your primary goal is to get a detailed overview of your entire net worth and investment portfolio, Monarch is arguably more robust.

2. Simplifi by Quicken

For users who feel overwhelmed by too much data, Simplifi offers a breath of fresh air. It’s designed with a clean, intuitive interface that makes it easy to track spending, monitor subscriptions, and create savings goals without a steep learning curve.

Key Features: A user-friendly dashboard, real-time spending alerts, and dedicated watchlists to monitor specific spending categories.

Why Choose It Over Rocket Money? Simplifi is ideal for those who want powerful features in a less cluttered, more straightforward package.

3. YNAB (You Need A Budget)

YNAB is more than an app; it's a budgeting philosophy. It uses the zero-based budgeting method, forcing you to be intentional with every dollar you earn. It doesn't automatically find your subscriptions, but its methodology ensures you're actively aware of every single recurring expense.

Key Features: A proven, proactive budgeting system, goal tracking for savings and debt payoff, and a wealth of educational content.

Why Choose It Over Rocket Money? Choose YNAB if you want to fundamentally change your spending habits and take a hands-on approach to your budget, rather than just tracking it.

4. SubTracker

If your main frustration is subscriptions and you don't need a full-blown budgeting app, SubTracker is a focused alternative. It is built specifically for tracking, budgeting, and managing recurring payments, offering a streamlined experience.

Key Features: Automatic subscription import, smart renewal reminders, and budget analysis focused solely on subscriptions.

Why Choose It Over Rocket Money? It’s a great choice for users who want a dedicated subscription tool without the additional complexity of a comprehensive financial planner.

5. SubBuddy (Our Pick)

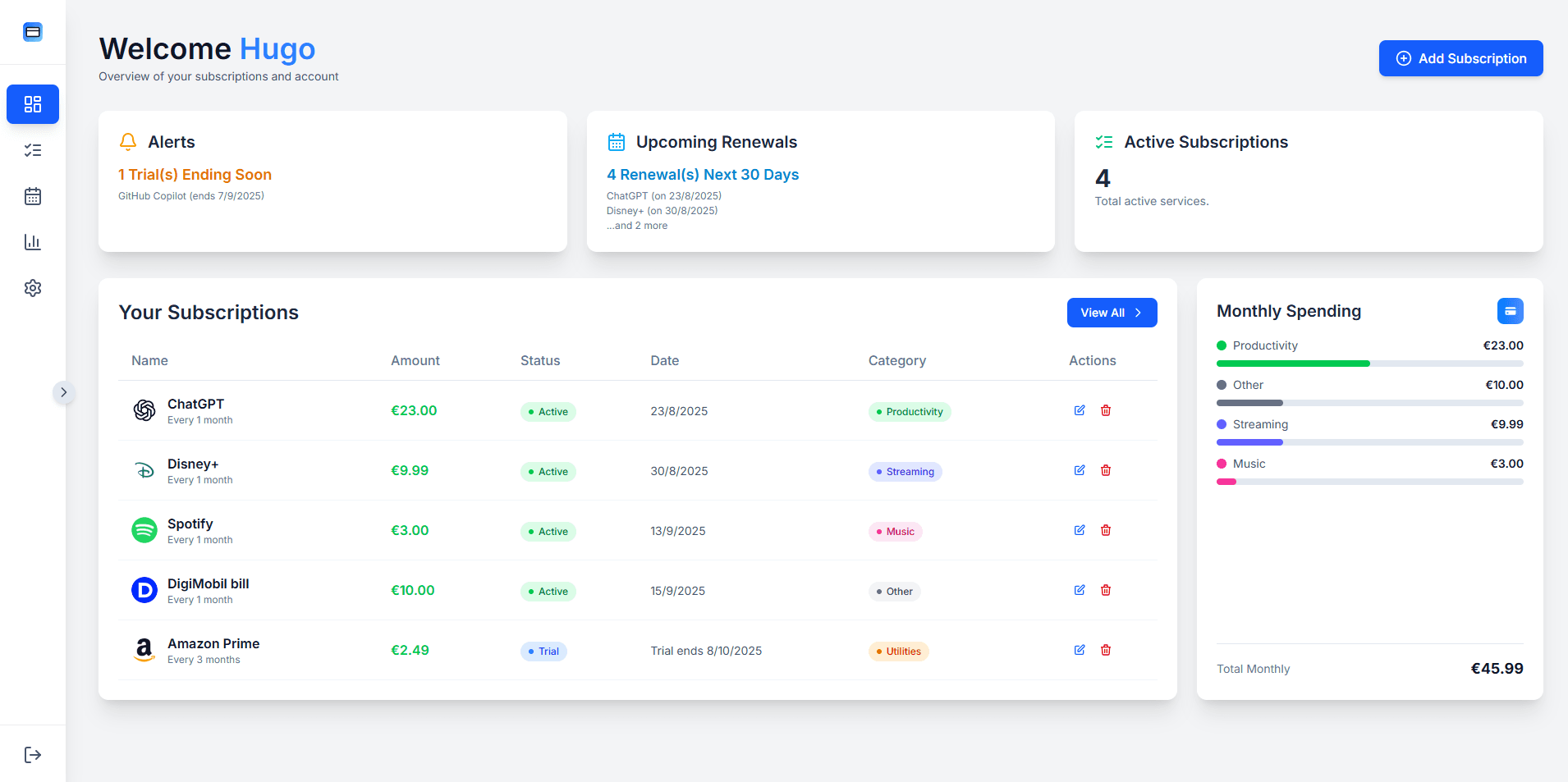

We built SubBuddy to be the ideal solution for people who find other apps too complex or too limited. We focus on providing the clearest, most intuitive subscription management experience possible, giving you full control without the clutter.

Key Features: A crystal-clear dashboard, a visual calendar for all renewals, insightful analytics, and upcoming AI-powered optimizations. We prioritize manual entry to build awareness, with powerful automation features on our public Roadmap.

Why Choose It Over Rocket Money? SubBuddy is for you if you want a beautifully designed, dedicated tool that excels at one thing: managing your subscriptions. Our transparent pricing—a 1-month free trial and a simple lifetime deal—also stands in contrast to the multi-tiered premium models of competitors. We give you the essential tools to feel in control, not overwhelmed.

Conclusion

The best tool is the one that aligns with your financial goals. While Rocket Money is a solid all-in-one solution, alternatives like Monarch Money offer deeper investment insights, YNAB provides a disciplined methodology, and dedicated trackers like SubBuddy offer focused simplicity. We encourage you to try our free trial and see if our approach to subscription management is the right fit for you.

Curious about the subscription crisis we're all trying to solve? Check out our data-driven analysis: How the Average American Wastes $273/Month on Subscriptions. And if you want to know the story behind SubBuddy, read Why I Built SubBuddy: The Personal Story Behind the App.

Alex Coca

Founder & CEO of SubBuddy. Passionate about helping people gain clarity and control over their entire financial life, one recurring payment at a time.

Ready to Simplify Your Subscriptions?

Start tracking all your recurring expenses with a tool designed for clarity and control.

Go to Your DashboardRelated Articles

How the Average American Wastes $273/Month on Subscriptions (And How to Fix It)

Recent studies reveal Americans spend 2.5x more on subscriptions than they estimate. Here's the hard data and a step-by-step plan to reclaim your money.

Why I Built SubBuddy: The Personal Story Behind the App

The moment I discovered I was paying for 12 subscriptions I'd forgotten about, I knew something had to change. Here's the personal journey that led to creating SubBuddy.

The Top 7 Subscriptions You Probably Forgot You're Paying For

It's the silent budget killer: the small, recurring charges for services you no longer use. We call them 'vampire subscriptions,' and here's how to find them.